The Rise of Electric Vehicles

Electric vehicles (EVs) are no longer a niche curiosity—they’re reshaping global transportation, driven by plummeting battery costs, aggressive government policies, and consumer demand for sustainable mobility. As of November 2025, EV sales are on track for a record year, with projections showing over 20 million units sold worldwide, capturing about 24% of the global passenger car market. This surge reflects a 25% year-over-year increase from 2024, fueled by advancements in affordable models and expanding charging infrastructure. Yet, challenges like policy uncertainty in the U.S. and supply chain strains highlight that the road ahead isn’t entirely smooth.

Key Drivers of EV Growth

The Rise of Electric Vehicles: Accelerating Toward Mainstream Adoption in 2025

Electric vehicles (EVs) are no longer a niche curiosity—they’re reshaping global transportation, driven by plummeting battery costs, aggressive government policies, and consumer demand for sustainable mobility. As of November 2025, EV sales are on track for a record year, with projections showing over 20 million units sold worldwide, capturing about 24% of the global passenger car market. This surge reflects a 25% year-over-year increase from 2024, fueled by advancements in affordable models and expanding charging infrastructure. Yet, challenges like policy uncertainty in the U.S. and supply chain strains highlight that the road ahead isn’t entirely smooth.

Below, we break down the key drivers, current trends, regional variations, and future outlook.

Key Drivers of EV Growth

The EV boom stems from a convergence of economic, environmental, and technological forces:

- Falling Battery Costs: Lithium-ion battery prices have dropped 20% in 2024-2025, making EVs more affordable. BloombergNEF estimates batteries will cost under $100/kWh by 2026, enabling mid-range EVs to undercut gas cars on total ownership costs.

- Government Incentives and Regulations: Policies like the EU’s tightened CO2 standards (effective 2025) and China’s extended trade-in subsidies are pushing adoption. In the U.S., state-level rebates persist despite federal rollbacks.

- Consumer Shifts: Surveys show 30-40% of buyers in mature markets now prioritize EVs for lower operating costs (electricity vs. fuel) and environmental benefits. Hybrids bridge the gap for range-anxious consumers.

- Corporate Commitments: Automakers like BYD, Tesla, and Volkswagen are ramping up production, with over 1,000 EV models available globally in 2025 (up 15% from 2024).

Global Market Trends and Statistics

Global EV sales hit 17.8 million in 2024 and are projected to reach 21.3 million in 2025, per EV Volumes data. Battery electric vehicles (BEVs) dominate at ~60% of sales, with plug-in hybrids (PHEVs) filling the rest. Here’s a snapshot:

Sources: BloombergNEF, IEA Global EV Outlook 2025, Statista.

Emerging trends include:

- Electrification Beyond Cars: Electric buses and two/three-wheelers are electrifying fastest, with 80%+ adoption in segments like India’s two-wheelers.

- Affordability Milestone: By late 2025, total cost of ownership for EVs is expected to match or beat internal combustion engine (ICE) vehicles in 70% of markets.

Regional Breakdown: Uneven but Accelerating Adoption

EV growth varies wildly by region, shaped by policy, infrastructure, and economics.

- China: The Undisputed Leader

China accounts for ~60% of global sales, with EVs at 51% market share in 2025. Sales are forecast to exceed 12 million units, boosted by subsidies and domestic giants like BYD. PHEVs now comprise 30% of EV sales here, up from 15% in 2020. - Europe: Policy-Driven Surge

EV sales rose 26% in H1 2025 to 2 million units, eyeing 25% market share by year-end. The UK’s Zero Emission Vehicle mandate (22% BEV/FCEV sales) and EU CO2 rules are key. Norway leads at 80%+ share, while Germany and France rebound with subsidies. - United States: Slowing Amid Uncertainty

U.S. EV adoption hit 10% in 2025 (up from 7.9% in 2023), but growth slowed to 16% due to federal tax credit phase-outs and tariffs. California bucks the trend at mass adoption levels, with state incentives driving 20%+ share. Cumulative sales could fall 14 million short of prior forecasts by 2030. - Emerging Markets: The Next Frontier

Southeast Asia (e.g., Thailand, Vietnam) and Latin America (Brazil) saw 50%+ sales growth, with Chinese imports dominating 80%+ in some areas. India’s EV share hits 7.5% by December 2025, doubling from 2024 via subsidies like Madhya Pradesh’s EV Policy.

Recent X discussions highlight optimism: Analysts note EVs as “1 in 4 cars sold globally,” with emerging markets “taking off” despite U.S. slowdowns.

Challenges on the Horizon

Despite the momentum:

- Infrastructure Gaps: Global charging points lag behind vehicles (1:10 ratio in many areas), straining grids in high-adoption regions.

- Supply Chain Bottlenecks: Battery metals like lithium face volatility; solid-state batteries could claim 10% market by 2035 but need scaling.

- Policy Risks: U.S. rollbacks could slash battery demand 47% by 2040 in a worst-case scenario. High upfront costs persist in low-incentive markets.

- Consumer Hesitations: Range anxiety and resale value concerns slow uptake, though hybrids mitigate this (15% global share in 2025).

Future Outlook: A Tipping Point by 2030

Projections paint a transformative decade:

- Sales Trajectory: 40 million units by 2030 (40% share), reaching 56% by 2035 in baseline scenarios.

- Fleet Impact: EVs surpass ICE fleets in Norway (2030), China (2033), and California (2037). Global stock hits 245 million by 2030 (excluding two-wheelers).

- Broader Implications: EVs could displace 5 million barrels of oil daily by 2030, boost public charging revenue to $220 billion by 2040, and cut transport emissions 40%.

- Innovation Edge: Expect cheaper LFP batteries, vehicle-to-grid tech, and AI-driven autonomy to accelerate adoption.

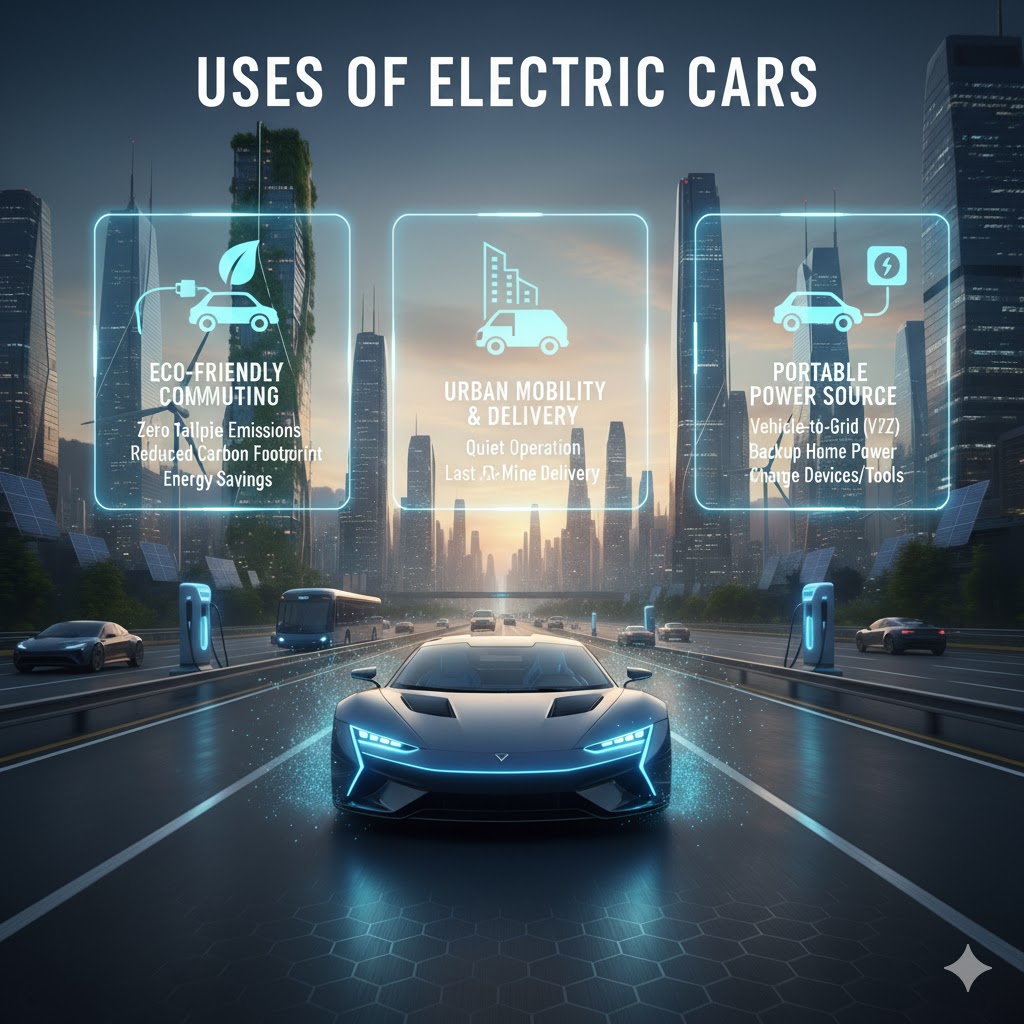

Uses of Electric Cars

1. Personal Transportation

2. Commercial & Fleet Operations

3. Public & Municipal Services

4. Specialized & Industrial Uses

5. Energy Grid Support (V2G & V2X)

6. Emerging & Niche Uses

7. Environmental & Societal Benefits

Electric cars

Affordable & Upcoming Gems

- Fiat 500e ($30,500, 149 miles): Tiny Italian city zipster—perfect for urban jaunts.

- Renault 5 (R5) (~$28,000, 193 miles): Retro charm meets modern EV efficiency; hitting Europe first.

- Tesla Model Q (est. <$30,000, TBD): Budget Tesla launching mid-2025 for mass appeal.

- BMW iX3 (est. $55,000, 300+ miles): Sleek SUV with 800V fast-charging; late 2025 debut.

- Tesla: Model 3, Model Y, Cybertruck

- Ford: Mustang Mach-E, F-150 Lightning

- Hyundai: Ioniq 5, Ioniq 6, Ioniq 9

- Chevrolet: Equinox EV

- Porsche: Taycan

- Kia: EV6, EV9

- BMW: iX, i4, i7

- Volkswagen: ID Buzz

- Rivian: R1T

- Audi: e-tron GT, Q4 e-tron

- Mercedes-Benz: EQS

- Nissan: Leaf

- BYD: Atto 3

- Honda: Prologue

- Jeep: Avenger

- Rolls-Royce: Spectre

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

ASK