The “2009 Panic” Hook

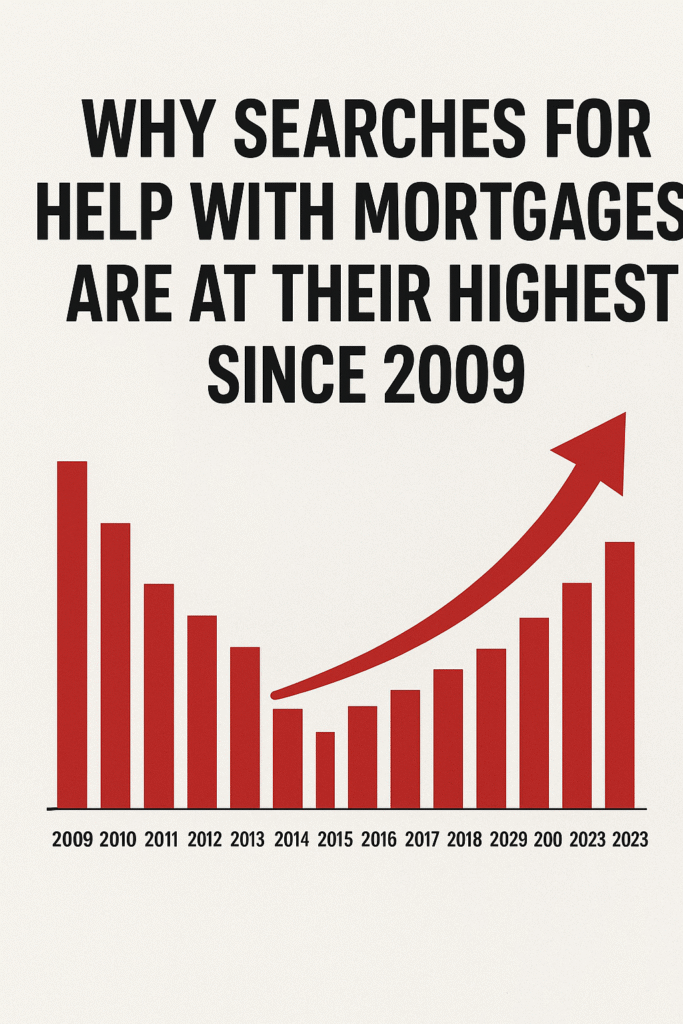

Searches for “help with mortgage” are at a high point since 2009 primarily due to a combination of elevated home prices and high mortgage interest rates, which have made housing increasingly unaffordable for many Americans. Google search interest for terms like “help with mortgage” reached its highest level since 2009 in August 2025, according to Google Trends data analyzed by multiple outlets. This spike echoes the post-2008 financial crisis era, when foreclosure rates soared amid the housing market collapse, but experts caution that today’s trend doesn’t necessarily signal an imminent repeat—though it does highlight real strains on American homeowners and buyers. The data reflects a broad uptick in queries (not always the exact phrase), which can include general advice on applications alongside distress signals like payment struggles. However, narrower searches (e.g., “help with mortgage payments”) show less dramatic increases.Searches for mortgage help have reached their highest level since 2009 due to a combination of factors, including rising mortgage rates, high housing costs, and general economic uncertainty that causes people to seek proactive advice, not just financial distress. While this surge mirrors the 2009 financial crisis, it is not a direct indicator of an impending housing crisis, as signs of distress like foreclosures are significantly lower now than they were then. The search increase also includes people looking for general mortgage information and help with the application process, not just those in immediate danger of defaulting.

- Housing Unaffordability: The typical household is spending a significant portion of its monthly income on mortgage payments (around 38%). Home prices are near record levels, and with mortgage rates (well over 6%) remaining high, the cost of owning a home has become a major financial strain.

- High Interest Rates: The Federal Reserve has been raising interest rates to combat inflation, which has led to a sharp increase in mortgage rates from historic lows (below 3% in 2020/2021). These elevated rates mean higher monthly payments, reducing a borrower’s purchasing power and making it harder to qualify for a loan.

- Stagnant Incomes (relative to housing costs): While the labor market has been generally strong, “sticky” costs like rent, insurance, and shelter have remained stubbornly high, stretching family paychecks thin and making it difficult to save for a down payment or manage existing payments.

- Increased Search Volume Nuances: The general search term “help with mortgage” (without quotes) also includes people looking for application assistance, refinancing information, or general guidance, not just those facing payment stress. However, the spike in search activity could indicate brewing financial distress for some homeowners.

| Factor | Description | Impact on Searches |

|---|---|---|

| Persistent High Mortgage Rates | Despite the Federal Reserve’s first rate cut since December 2024 (in September 2025), 30-year fixed rates rebounded to 6.34% by early October—still up 0.22% from a year prior. Over 81% of existing homeowners locked in sub-6% rates pre-2022, creating a “lock-in effect” where they avoid selling or refinancing. | New buyers and recent purchasers face unaffordable payments, driving queries for assistance programs or refinancing tips. Monthly mortgage costs hit $2,800 in 2025—nearly double 2020 levels and 2,300% above 1955. |

| Housing Affordability Crisis | Home prices remain elevated post-pandemic, with demand outstripping supply due to zoning limits and slow construction. Incentives from builders are at “abnormally high” levels, but buyer caution persists amid rising personal debt. | First-time buyers (e.g., millennials/Gen Z) search for down payment aid or creative financing, while upgraders seek equity access. Mortgage applications for purchases were 43% below 2019 levels in April 2025, signaling suppressed demand but heightened anxiety. |

| Economic Slowdown and Job Market Weakness | U.S. private payrolls added just 42,000 jobs in recent months (per CNBC, November 2025), with broader slowdown signs like stagnant wages and inflation eroding disposable income. Broader debt growth and tax policies favoring ownership exacerbate this. | Homeowners facing job loss or income dips turn to searches for forbearance or modification programs, especially as 50% of Canadian mortgages (a parallel market) renew in 2025-26 at higher rates, prompting U.S. parallels in cross-border discussions. |

| Policy and Market Uncertainty | Recent proposals like 50-year mortgages (floated by President Trump to boost affordability) have sparked debate, potentially inflating demand and prices further (5-15% short-term hikes per economic models). Changes in lender scrutiny (e.g., flagging “technicalities” on renewals) add stress. Google’s own data methodology shifts since 2011 make exact 2009 comparisons imperfect. | Viral charts on X (formerly Twitter) amplified awareness, with users like Sen. Elizabeth Warren labeling it “Donald Trump’s housing market.” Discussions blend optimism (e.g., lower payments aiding stability/marriage) with fears of a “money cartel” or price bubbles. |

Unlike the 2009 financial crisis, which was characterized by widespread foreclosures and loose lending standards, current indicators like foreclosure rates and serious delinquency rates remain relatively low. The current situation is largely driven by a lack of housing supply and high demand, rather than subprime lending issues.

The search spike reflects the current challenging economic environment where the goal of homeownership has become more difficult to attain and maintain for many individuals and families.

Different Underpinnings: Unlike 2008-09’s adjustable-rate mortgage explosion and subprime lending frenzy, today’s market has stronger underwriting and fewer risky loans. No Mass Foreclosure Wave: Delinquency rates are low (under 4%), and equity buffers protect most owners. Searches may partly reflect proactive planning rather than desperation. Potential Relief Ahead: Further Fed cuts could ease rates to 5-6% by mid-2026, and stabilizing incomes might allow catch-up. However, without supply boosts, affordability could worsen.

Key Reasons:

Key Reasons for “Help with Mortgage” Searches at Highest Since 2009:

- High Mortgage Rates

- 30-year fixed rates ~6.3–6.8% in 2025 (vs. <3% in 2020–21)

- 81% of homeowners locked in at <6%, creating a “rate lock-in” effect — no incentive to move or refinance

- Unaffordable Home Prices

- Median home price >$400K; monthly payment ~$2,800 (2x 2020 levels)

- Builder incentives at record highs, yet demand remains suppressed

- Economic Slowdown

- Weak job growth (e.g., +42K private payrolls in late 2025)

- Stagnant wages + rising personal debt erode payment capacity

- Policy & Market Uncertainty

- Viral X/Twitter charts (e.g., Sen. Warren: “Trump’s housing market”)

- Proposals like 50-year mortgages spark fear of price inflation

- Proactive + Distress Searches

- Mix of:

- First-time buyers seeking down-payment help

- Recent buyers struggling with payments

- Homeowners exploring forbearance/modification

Not a 2009 Repeat: Stronger lending standards, low delinquencies (<4%), high homeowner equity.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.